Digital Transformation in Banking and Financial Services

Overview

- Cross-Channel Marketing: The 4×4 of Strategies

- Digital Customer Journey: Optimize Every Touchpoint for a Satisfying Experience

- 5 Ways Retail and Ecommerce Brands Can Boost Omnichannel Customer Engagement with indigitall

- Omnichannel vs Multichannel: Choose the Ideal Strategy

- Not sure if you’re connecting with your customers? Measure customer engagement.

Introduction to Digital Transformation

The financial sector is undergoing a profound transformation, driven by technological advancements and changing customer expectations. This chapter explores the concept of digital transformation in banking and financial services, highlighting the urgent need for change and the key drivers propelling this revolution.

Defining Digital Transformation in the Financial Sector

Digital transformation in banking refers to the integration of cutting-edge technologies and innovative strategies into financial services to enhance operational efficiency, improve customer experiences, and adapt to the evolving market landscape. This process involves:

- Modernizing traditional banking systems and processes

- Adopting new business models

- Leveraging data analytics, artificial intelligence, and machine learning

- Providing omnichannel banking experiences

- Personalizing products and services

The goal is to create a seamless, convenient, and secure banking environment that meets the demands of the digital age.

The Urgency for Change in Traditional Banking Models

Traditional banks are facing unprecedented challenges that necessitate immediate action:

- Competitive pressure: New digital-only banks and fintech startups are rapidly gaining market share. Europe's three largest neobanks – Revolut, N26, and Monzo – have amassed 23 million registered users and continue to grow.

- Changing customer expectations: Nearly half of consumers surveyed report that their current banking relationships are neither rewarding nor emotionally connected.

- Technological obsolescence: 95% of banking executives believe their current approach and tech stack are unable to optimize data for customer-centric growth.

- Shifting market dynamics: 65% of banking executives predict that physical branches will all but disappear within the next five years.

- Financial pressures: Traditional banks are burdened with high operational costs compared to their more agile digital competitors.

Key Drivers of Digital Transformation

Several factors are propelling the digital transformation in banking:

- Customer-centricity: Banks are shifting from product-centric to customer-centric models to provide personalized, need-based financial solutions.

- Technological advancements: Emerging technologies like AI, blockchain, and cloud computing are enabling new capabilities and efficiencies.

- Data-driven insights: The ability to leverage big data for deeper customer understanding and improved decision-making is becoming crucial.

- Regulatory changes: Open banking initiatives and evolving compliance requirements are pushing banks to innovate.

- Cost optimization: Digital transformation offers opportunities to streamline operations and reduce expenses.

- Competitive pressure: The rise of fintech companies and neobanks is forcing traditional banks to innovate or risk obsolescence.

- Changing workforce dynamics: The need for digital skills and a culture of innovation is reshaping the banking workforce.

To remain competitive, banks must embrace an "ambidextrous" approach, balancing short-term value drivers with long-term innovation. This transformation is not merely an incremental improvement but a fundamental reconfiguration of the entire banking business model.

As we delve deeper into this blog, we will explore how banks can navigate this digital transformation journey, leveraging new technologies and strategies to thrive in the rapidly evolving financial landscape.

The Evolving Financial Landscape

The banking and financial services sector is undergoing a profound transformation, driven by rapidly changing customer expectations, the rise of innovative competitors, and an evolving regulatory environment. This chapter explores these key factors reshaping the financial landscape.

Changing Customer Expectations and Behaviors

Today's customers have radically different expectations from their financial service providers compared to just a decade ago:

- Personalization: 73% of customers now expect better personalization as technology advances. They demand tailored financial products and services that adapt to their unique needs and preferences.

- Seamless omnichannel experiences: Customers expect consistent interactions across all touchpoints, whether online, mobile, or in-branch. However, 56% of customers report having to repeat information to different representatives, indicating a gap in meeting this expectation.

- Instant gratification: The era of waiting days for transactions to process is over. Customers now expect real-time payments, instant account opening, and immediate loan approvals.

- Digital-first approach: With the widespread adoption of smartphones, customers prefer managing their finances through mobile apps and online platforms rather than visiting physical branches.

- Transparency and trust: In an age of data breaches and privacy concerns, 79% of customers are increasingly protective of their personal data. They expect clear explanations of how their data is used and robust security measures.

Emergence of Fintech Competitors and Neobanks

The financial sector is witnessing an influx of new players that are challenging traditional banking models:

- Fintech disruptors: Innovative startups are leveraging technology to offer specialized financial services, from peer-to-peer lending to robo-advisors, often at lower costs and with greater convenience.

- Neobanks: Digital-only banks like Revolut, N26, and Monzo have gained significant market share, particularly among younger demographics. These banks offer streamlined services, often with lower fees and more user-friendly interfaces.

- Big Tech entry: Technology giants like Apple, Google, and Amazon are entering the financial services arena, leveraging their vast customer bases and technological expertise to offer payment solutions and other financial products.

- Ecosystem players: Non-financial companies are increasingly embedding financial services into their offerings, blurring the lines between industries and creating new competitive pressures.

Regulatory Changes and Compliance Challenges

The regulatory landscape for financial institutions is becoming increasingly complex:

- Open Banking initiatives: Regulations like PSD2 in Europe are mandating banks to share customer data with third-party providers, fostering innovation but also creating new compliance challenges.

- Data protection regulations: Laws like GDPR and CCPA are imposing strict requirements on how financial institutions handle customer data, necessitating significant investments in data management and security.

- Anti-money laundering (AML) and Know Your Customer (KYC) requirements: Increasingly stringent regulations aimed at combating financial crime are adding to compliance costs and operational complexity.

- Cybersecurity regulations: As cyber threats evolve, regulators are imposing more rigorous standards for cybersecurity, requiring banks to continually update their security measures.

- Cryptocurrency and blockchain regulations: The rise of digital assets is prompting regulators to develop new frameworks, creating both opportunities and challenges for traditional financial institutions.

- Environmental, Social, and Governance (ESG) reporting: Growing emphasis on sustainable finance is leading to new disclosure requirements and investment criteria.

This evolving landscape presents both challenges and opportunities for financial institutions. To thrive in this new environment, banks and financial service providers must embrace digital transformation, prioritize customer-centricity, and develop agile approaches to compliance and innovation. The following chapters will delve deeper into strategies and technologies that can help financial institutions navigate these changes successfully.

Core Technologies Reshaping Finance

The financial sector is undergoing a profound transformation driven by cutting-edge technologies. These innovations are revolutionizing how banks and financial institutions operate, interact with customers, and manage risk.

Artificial Intelligence and Machine Learning

AI and ML are fundamentally changing the landscape of financial services:

- AI-powered chatbots and virtual assistants: These tools provide 24/7 customer support, handling routine inquiries and transactions. Banks using AI chatbots have seen up to 70% cost reduction in customer service operations.

- Predictive analytics for risk assessment and fraud detection: AI algorithms analyze vast amounts of data to identify potential risks and fraudulent activities in real-time. This has led to a 50% reduction in false positives for fraud detection in some institutions.

- Personalized financial advice and product recommendations: AI-driven systems analyze customer data to offer tailored financial advice and product suggestions, increasing customer engagement and sales conversion rates by up to 30%.

How Indigitall can help:

Indigitall's AI-powered platform can enhance these capabilities by:

- Integrating with existing AI chatbots to deliver personalized push notifications

- Using machine learning algorithms to optimize message timing and content

- Providing analytics to refine AI-driven personalization strategies

Blockchain and Cryptocurrencies

Blockchain technology and digital assets are disrupting traditional banking models:

- Blockchain applications in banking: From cross-border payments to trade finance, blockchain is streamlining processes and reducing costs. Banks adopting blockchain for cross-border payments have reported up to 70% cost savings.

- The rise of cryptocurrencies and digital assets: Major financial institutions are now offering cryptocurrency custody and trading services to meet growing demand.

- Smart contracts and decentralized finance (DeFi): These technologies are automating financial processes and creating new investment opportunities. The total value locked in DeFi protocols has grown from $1 billion in 2020 to over $50 billion in 2024.

Cloud Computing and Big Data

Cloud and big data technologies are transforming data management and analysis in finance:

- Benefits of cloud migration for financial institutions: Cloud adoption has led to up to 40% reduction in IT costs and improved scalability for many banks.

- Leveraging big data for customer insights: Banks using big data analytics have seen up to 15% increase in revenue through improved customer targeting and product development.

- Data security and privacy considerations: Financial institutions are investing heavily in cloud security, with spending expected to reach $10 billion annually by 2025.

Mobile and Digital Banking Platforms

The shift to digital banking is accelerating:

- The shift to mobile-first banking: Over 80% of consumers now use mobile banking apps, with some digital-only banks reporting customer acquisition costs 40% lower than traditional banks.

- Omnichannel customer experiences: Banks providing seamless omnichannel experiences have seen customer satisfaction scores improve by up to 20%.

- Digital wallets and contactless payments: The use of digital wallets is expected to surpass cash and credit cards in many countries by 2025, with transaction volumes growing by 30% annually.

How Indigitall can help:

Indigitall's platform can enhance mobile and digital banking strategies by:

- Enabling personalized push notifications across web and mobile platforms

- Facilitating omnichannel communication through integration with various messaging channels

- Providing real-time analytics to optimize digital engagement strategies

- Supporting location-based notifications for relevant offers and services

By leveraging Indigitall's capabilities, financial institutions can create more engaging, personalized digital experiences that drive customer loyalty and increase adoption of digital banking services. The platform's AI-driven approach to message optimization and its ability to integrate across multiple channels make it a valuable tool in the evolving landscape of digital finance.

Transforming Banking Operations

The digital revolution is reshaping core banking operations, from customer onboarding to back-office processes and the way banks interact with the broader financial ecosystem.

Digital-First Customer Onboarding

- Streamlining account opening processes: Banks are moving towards fully digital account opening, reducing the time from days to minutes. This shift has led to a 40% reduction in account opening costs for some institutions.

- Know Your Customer (KYC) and identity verification: Advanced biometric technologies and AI-driven document verification are enhancing security while simplifying the KYC process. Banks implementing these technologies have seen up to 80% reduction in KYC processing times.

- Enhancing customer experience through digital channels: Digital onboarding allows customers to open accounts anytime, anywhere, improving satisfaction and increasing conversion rates by up to 20%.

How Indigitall can help:

- Enable personalized push notifications to guide customers through the onboarding process

- Provide real-time analytics to identify and address drop-off points in the digital onboarding journey

- Facilitate seamless communication across channels to support a unified onboarding experience

Automating Back-Office Processes

- Robotic Process Automation (RPA) in banking operations: RPA is transforming routine tasks such as data entry, reconciliation, and reporting. Banks implementing RPA have reported up to 70% cost savings in targeted processes.

- Improving operational efficiency and reducing costs: Automation is not only reducing errors but also freeing up staff for higher-value tasks. Some banks have achieved a 50% reduction in processing time for loan applications through automation.

- Challenges and best practices in automation implementation: While promising, automation requires careful planning and change management. Successful implementations focus on employee reskilling and process redesign alongside technology deployment.

Open Banking and APIs

- The concept of open banking: Open banking mandates banks to share customer data with third-party providers, fostering innovation and competition. It's expected to create a $416 billion revenue opportunity by 2026.

- Building financial ecosystems through APIs: Banks are leveraging APIs to create platforms that integrate various financial services. This approach has allowed some banks to increase their product offerings by 50% without significant internal development.

- Opportunities and challenges in data sharing: While open banking presents opportunities for new revenue streams and improved customer experiences, it also raises concerns about data security and privacy. Banks are investing heavily in API security measures to address these challenges.

By embracing these transformative approaches, banks can significantly enhance their operational efficiency, improve customer experiences, and position themselves competitively in the evolving financial landscape. The key to success lies in a strategic approach that balances innovation with security and regulatory compliance.

Indigitall's platform can play a crucial role in this transformation by providing the tools necessary for personalized customer engagement across digital channels, supporting the seamless integration of various banking processes, and offering valuable insights through advanced analytics. By leveraging Indigitall's capabilities, banks can create more engaging, efficient, and customer-centric digital experiences throughout their operations.

Innovating Financial Products and Services

Personalized Banking Services

- Using data analytics for tailored product offerings: Banks are leveraging big data and advanced analytics to create hyper-personalized products. This approach has led to a 20% increase in product adoption rates for some institutions.

- AI-driven financial planning and wealth management: Robo-advisors and AI-powered wealth management tools are democratizing access to financial advice. These platforms have seen a 300% growth in assets under management over the past three years.

- Gamification in personal finance management: Banks are incorporating game-like elements into their apps to encourage better financial habits. This strategy has increased user engagement by up to 40% in some cases.

Digital Lending and Credit Scoring

- Alternative credit scoring models: AI-powered models are considering non-traditional data points, enabling banks to serve previously underbanked populations. This has expanded the potential customer base by up to 50 million in the US alone.

- P2P lending platforms and marketplace lending: These platforms are disrupting traditional lending models, with global P2P lending expected to reach $558.91 billion by 2027.

- Streamlining the loan approval process: AI and automation have reduced loan approval times from days to minutes, improving customer satisfaction and operational efficiency.

Next-Generation Payment Solutions

- Real-time payments and instant transfers: The adoption of real-time payment systems has grown by 35% globally in the past year, revolutionizing both consumer and business transactions.

- Biometric authentication for secure transactions: Biometric authentication methods are becoming increasingly common, with 68% of banks planning to implement biometric ID systems by 2025.

- The future of digital currencies and central bank digital currencies (CBDCs): Over 80% of central banks are now exploring CBDCs, with some already in pilot stages.

Navigating the Digital Transformation Journey

Building a Digital Culture

- Fostering innovation and agility in traditional banks: Banks are establishing innovation labs and partnering with fintech startups to drive cultural change.

- Upskilling and reskilling the workforce: 54% of employees will require significant reskilling by 2025, according to the World Economic Forum.

- Change management strategies for digital adoption: Successful digital transformations are 30% more likely when coupled with effective change management strategies.

Cybersecurity in the Digital Age

- Emerging cyber threats in digital banking: Cyberattacks on financial institutions have increased by 238% since the start of the COVID-19 pandemic.

- Advanced security measures and fraud prevention: AI-powered fraud detection systems have reduced false positives by up to 60% while improving detection rates.

- Balancing security with user experience: Banks are implementing risk-based authentication to enhance security without compromising user experience.

Regulatory Compliance and Risk Management

- Adapting to evolving regulatory landscapes: Banks are spending up to 10% of their operating costs on compliance.

- RegTech solutions for compliance automation: The global RegTech market is expected to grow to $55.28 billion by 2025, with a CAGR of 52.8%.

- Managing digital risks and ensuring data protection: Banks are implementing advanced data encryption and blockchain technologies to enhance data protection.

The Future of Banking

Emerging Trends and Technologies

- The potential of quantum computing in finance: Quantum computing could revolutionize risk modeling and fraud detection, with 40% of banks expecting to use quantum computing by 2025.

- Augmented and virtual reality in banking services: AR and VR are being explored for immersive financial education and virtual branch experiences.

- The role of 5G in enhancing digital banking capabilities: 5G is expected to enable new mobile banking services and improve the performance of existing ones.

Sustainable and Ethical Banking

- Integrating ESG considerations into digital strategies: 67% of banks are now incorporating ESG factors into their risk management processes.

- Green fintech and sustainable finance initiatives: The green bond market has grown to over $1 trillion, with fintech playing a crucial role in its expansion.

- Promoting financial inclusion through digital solutions: Digital banking solutions have helped bring 1.2 billion previously unbanked individuals into the formal financial system since 2011.

Conclusion: Embracing the Digital Future

As banks navigate this digital transformation, the key to success lies in embracing innovation while maintaining trust and security. The future of banking will be characterized by personalized, AI-driven services, seamless digital experiences, and a strong focus on sustainability and inclusion.

How Indigitall is Helping Banks

Indigitall is playing a crucial role in supporting banks through this digital transformation:

- Personalized Communication: Indigitall's AI-driven platform enables banks to deliver highly personalized messages across multiple channels, increasing customer engagement and product adoption rates.

- Omnichannel Experience: By integrating with various messaging channels, Indigitall helps banks create a seamless omnichannel experience, crucial for modern banking services.

- Real-time Analytics: Indigitall provides banks with real-time insights into customer behavior and campaign performance, enabling them to optimize their digital strategies continuously.

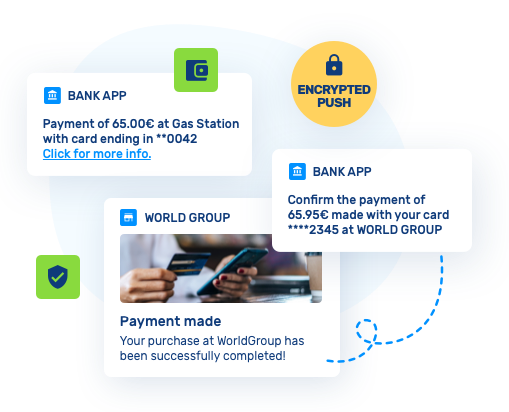

- Secure Messaging: With advanced encryption and compliance features, Indigitall ensures that all communications are secure and in line with regulatory requirements.

- AI-powered Automation: Indigitall's platform automates many aspects of customer communication, freeing up bank staff to focus on more complex tasks and improving operational efficiency.

- Customer Journey Optimization: By analyzing customer interactions across touchpoints, Indigitall helps banks optimize the entire customer journey, from onboarding to long-term engagement.

- Integration Capabilities: Indigitall seamlessly integrates with existing banking systems, allowing banks to leverage their current infrastructure while enhancing it with new digital capabilities.

By leveraging Indigitall's innovative solutions, banks can accelerate their digital transformation, enhance customer experiences, and stay competitive in the rapidly evolving financial landscape.