Article

Omnichannel Banking: Everything You Need to Know for 2025

Omnichannel banking has become a critical strategy for financial institutions looking to enhance customer experience, increase engagement, and drive return on investment (ROI) in today’s digital age. This comprehensive approach integrates various customer touchpoints to create a seamless, consistent banking experience across all channels. In this blog, we’ll cover:

-

- What is Omnichannel banking?

-

- Omnichannel vs. Multichannel

-

- What are the benefits of Omnichannel Banking?

-

- What are the challenges of Omnichannel Banking?

-

- What is the architecture of Omnichannel Banking?

-

- Omnichannel banking trends

- How indigitall can help you engage and retain your customers

What is Omnichannel Banking?

Omnichannel banking is a customer-centric approach that integrates multiple channels into a cohesive and engaging customer experience. It goes beyond the traditional multichannel approach by seamlessly integrating all touchpoints, allowing customers to initiate interactions through one channel and effortlessly continue them on another without disruption.

Multichannel vs. Omnichannel Banking

Omnichannel marketing and multichannel marketing are both strategies that utilize multiple channels to reach customers, but they differ significantly in their approach and execution. Multichannel marketing focuses on using various channels independently to maximize reach, with each channel operating in its own silo and often leading to a disjointed customer experience.

In contrast, omnichannel marketing emphasizes creating a seamless, integrated experience across all touchpoints, allowing customers to move effortlessly between channels while maintaining a consistent brand interaction. While multichannel marketing may result in siloed data and repetitive messaging, omnichannel marketing integrates data from all channels to provide a holistic view of customer behavior, enabling more sophisticated personalization and targeting.

Omnichannel strategies typically require more complex technology integration and organizational alignment but generally yield higher customer satisfaction, loyalty, and lifetime value. Multichannel marketing may be easier to implement and suitable for businesses with limited resources, while omnichannel marketing is better suited for companies aiming to provide a highly personalized, seamless customer experience. Ultimately, the choice between the two depends on a company’s resources, goals, and the complexity of their customer journey.

What are the Benefits of Omnichannel Banking?

Omnichannel banking offers numerous benefits that significantly enhance the customer experience and improve operational efficiency for financial institutions and credit unions. By providing a seamless, integrated experience across all touchpoints, omnichannel banking solutions allow customers to interact with their bank through their preferred channels, whether it’s online, mobile, in-branch, or via phone support. This flexibility and convenience lead to increased customer satisfaction and loyalty.

The integrated approach enables banks to gather comprehensive customer data, allowing for more personalized services and targeted marketing efforts. Operationally, omnichannel banking streamlines processes, reduces redundancies, and optimizes resource allocation, resulting in cost savings and improved efficiency. It also facilitates faster problem resolution by giving bank staff access to complete customer information across all channels.

Additionally, omnichannel banking positions banks as innovative and customer-centric, providing a competitive edge in attracting and retaining customers. Overall, the benefits of omnichannel banking include:

Enhanced Customer Experience

Omnichannel banking significantly improves the customer experience by providing:

1. Seamless transitions between channels

2. Consistent user interface and branding across all touchpoints

3. Personalized services based on customer data and preferences

Improve Your Customer Journey

By offering multiple integrated touchpoints, omnichannel banking enhances customer engagement through:

1. Personalized communications

2. Targeted marketing campaigns

3. Real-time interaction and feedback collection

Operational Efficiency

Banks can achieve greater operational efficiency by:

1. Integrating systems and processes across channels

2. Reducing redundancies and streamlining workflows

3. Allocating resources more strategically

Data-Driven Insights

Omnichannel banking generates valuable data on customer behavior, preferences, and transaction patterns, enabling banks to:

1. Gain actionable insights into market trends

2. Understand customer needs more deeply

3. Make data-driven decisions to optimize services and marketing strategies

Customer Engagement Driving ROI

Research has shown that effective customer engagement through omnichannel banking can significantly drive ROI for financial institutions. Here are some key findings:

Increased Customer Satisfaction and Loyalty

A study by McKinsey found that banks that successfully implement omnichannel strategies see a 20% increase in customer satisfaction rates. This increased satisfaction translates to higher customer loyalty, with omnichannel customers being 30% more likely to remain with their bank compared to single-channel customers.

Higher Cross-Selling Opportunities

Research by Deloitte revealed that omnichannel banking customers are 2.5 times more likely to purchase additional products from their bank compared to single-channel customers. This increased propensity for cross-selling can lead to significant revenue growth for banks.

Improved Customer Lifetime Value

A report by Boston Consulting Group showed that omnichannel banking customers have a 30% higher lifetime value compared to those who only use traditional banking channels. This increased value is attributed to higher engagement, more frequent transactions, and greater product adoption.

Cost Reduction

Accenture’s research indicates that banks implementing omnichannel strategies can reduce their cost-to-serve by up to 20% through improved operational efficiencies and increased digital adoption.

Enhanced Digital Adoption

A study by Forrester found that banks with robust omnichannel strategies see a 50% higher digital adoption rate among their customers. This shift towards digital channels can lead to significant cost savings and improved customer satisfaction.

What are the Challenges in Implementing Omnichannel Banking

While the benefits are substantial, banks face several challenges in implementing omnichannel strategies:

-

- Integration across channels: Connecting diverse systems and ensuring a unified customer experience across online banking, mobile apps, physical branches, etc. can be complex and resource-intensive.

-

- Data security and privacy: Protecting sensitive customer data as it’s exchanged across multiple platforms and channels is critical.

-

- Consistent user experience: Providing a cohesive experience across different channels is challenging, as users expect a unified journey.

-

- Regulatory compliance: Ensuring compliance with various financial regulations across different channels is demanding and requires ongoing adaptation.

-

- Technology adoption: Keeping up with rapidly evolving technology and investing in cutting-edge tools while ensuring staff and customers can utilize them.

-

- Legacy system integration: Integrating new omnichannel systems with existing legacy banking infrastructure can be complex.

-

- Data management: Collecting, storing, and leveraging customer data effectively across channels is challenging.

-

- Staff training and change management: Employees need training on new technologies and processes to serve customers across channels.

-

- Balancing functionality across channels: Not all channels may offer the same capabilities, so banks must balance customer expectations with channel limitations.

-

- Scalability and flexibility: Ensuring the omnichannel infrastructure can adapt and scale to accommodate changing customer behaviors and future technological advancements.

-

- Organizational silos: Breaking down siloed organizational structures to enable true omnichannel integration.

-

- Resource allocation: Securing sufficient resources and investment to successfully implement and maintain an omnichannel strategy.

Overcoming these challenges requires careful planning, significant investment in technology and training, and a commitment to creating a seamless, integrated banking experience across all customer touchpoints.

What is the Architecture of Omnichannel Banking?

Omnichannel banking architecture is designed to create a seamless, integrated experience across all customer touchpoints by leveraging a unified technology infrastructure. At its core, this architecture typically consists of a centralized customer data platform that consolidates information from various channels and systems. This central hub is connected to multiple front-end interfaces (mobile apps, websites, branch systems, ATMs, etc.) through APIs and middleware layers, ensuring consistent data flow and real-time updates across all channels.

The architecture also incorporates advanced analytics and AI capabilities to process customer data and deliver personalized experiences. Security layers are integrated throughout to protect sensitive information as it moves across channels. Additionally, the architecture often includes a robust content management system to ensure consistent messaging and branding across all touchpoints. This interconnected system allows for a 360-degree view of the customer, enabling banks to provide a cohesive, personalized experience regardless of how or where a customer chooses to interact with the bank.

Future Trends in Omnichannel Banking

The future of omnichannel banking is poised for significant evolution, driven by rapid technological advancements and changing customer expectations. As artificial intelligence and machine learning continue to mature, we can expect to see more sophisticated personalization in banking services, with AI-powered chatbots and virtual assistants providing increasingly nuanced and context-aware support across all channels.

-

- Biometric authentication is likely to become more prevalent, offering seamless and secure access to banking services through facial recognition, voice recognition, or even behavioral biometrics.

-

- The integration of Internet of Things (IoT) devices with banking platforms could enable new forms of automated financial management and real-time transaction processing.

-

- Augmented and virtual reality technologies may transform the way customers interact with their banks, offering immersive experiences for complex financial planning or virtual branch visits.

-

- Open banking initiatives and APIs will likely foster greater collaboration between traditional banks and fintech companies, leading to more innovative and integrated financial ecosystems.

-

- Blockchain technology could revolutionize backend operations, enhancing security, transparency, and efficiency in cross-channel transactions.

-

- As 5G networks become more widespread, we may see the emergence of ultra-low latency banking services, enabling real-time financial decisions and instant global transactions.

-

- The rise of voice-activated devices and smart home technology could make voice banking a common feature, allowing customers to perform banking tasks through natural language commands.

As these trends converge, omnichannel banking is set to become more predictive, proactive, and deeply integrated into customers’ daily lives, blurring the lines between traditional banking and broader financial management.

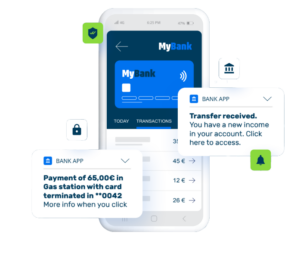

Discover How indigitall Can Help You Engage and Retain Your Customers

indigitall offers a comprehensive customer engagement platform that can help businesses significantly improve customer retention and engagement. Through its omnichannel capabilities, indigitall allows companies to coordinate and automate communications across multiple channels, including web push, in-app messaging, email, SMS, and WhatsApp. The platform’s AI-powered technology enables highly personalized messaging tailored to individual user preferences and behaviors. With features like A/B testing, campaign tracking, and detailed analytics, businesses can optimize their messaging strategies for maximum impact.

indigitall’s customer journey orchestration tools allow for the creation of automated, personalized communication flows that guide users through different stages of engagement. By providing a seamless, integrated experience across all touchpoints, indigitall helps businesses increase user engagement, reduce churn rates, and ultimately drive sales and customer lifetime value. The platform’s easy integration with existing systems and its intuitive interface make it a powerful tool for businesses looking to enhance their customer engagement strategies in today’s competitive digital landscape.

Conclusion

Omnichannel banking represents a significant shift in how financial institutions interact with their customers. By providing a seamless, integrated experience across all touchpoints, banks can meet the evolving expectations of modern consumers while improving their own operational efficiency and ROI. As the financial landscape continues to evolve, embracing omnichannel strategies will be crucial for banks looking to remain competitive and relevant in the digital age.

The research clearly demonstrates that effective customer engagement through omnichannel banking not only enhances customer satisfaction and loyalty but also drives significant ROI through increased cross-selling opportunities, improved customer lifetime value, and operational efficiencies. As banks continue to invest in and refine their omnichannel strategies, they are likely to see substantial returns in terms of customer retention, revenue growth, and market competitiveness.