Beyond Transactions: The Ultimate Guide to Customer Engagement in Banking

Beyond Transactions: The Ultimate Guide to Customer Engagement in Banking

Why Customer Engagement is the New Currency in Banking

In today’s digital-first world, the banking industry is undergoing a monumental shift. The traditional, transactional relationship between a bank and its customers is no longer enough. Consumers now expect the same level of personalized, seamless, and intuitive experience from their financial institutions as they receive from tech giants and e-commerce leaders. This is where customer engagement becomes the most critical metric for success.

True customer engagement in banking is about building a continuous, value-driven relationship that extends beyond deposits and withdrawals. It’s about understanding customer needs, anticipating their financial goals, and proactively offering solutions and guidance. Banks that master this will not only survive but thrive, creating a loyal customer base that is more profitable and less likely to churn.

The Tangible Benefits of Strong Customer Engagement

- Increased Customer Loyalty and Retention: Engaged customers feel valued and understood. This emotional connection makes them significantly less likely to switch banks, even if a competitor offers a slightly better interest rate.

- Higher Customer Lifetime Value (CLV): A highly engaged customer is more likely to use a wider range of the bank’s services, from loans and mortgages to investment products and insurance. This deepens the relationship and dramatically increases their lifetime value.

- Competitive Differentiation: In a market where products are often commoditized, the customer experience is the ultimate differentiator. Superior engagement is a powerful competitive advantage that is difficult for others to replicate.

- Valuable Data and Insights: Every interaction is a data point. Engaged customers provide more data, offering deeper insights into their behaviors and preferences, which can be used to further refine and personalize the banking experience.

The Pillars of a Modern Banking Engagement Strategy

Building a successful engagement strategy requires a foundational shift in thinking and technology. It rests on several key pillars that work together to create a cohesive and compelling customer journey.

1. Hyper-Personalization at Scale

Personalization in banking has evolved far beyond simply using a customer’s first name in an email. True hyper-personalization involves leveraging data and AI to deliver unique experiences tailored to each individual’s financial situation, goals, and behavior.

- Predictive Product Offers: Analyze transaction history and life events to proactively offer relevant products. For example, a customer making regular payments to a landlord could be targeted with a personalized mortgage pre-approval offer.

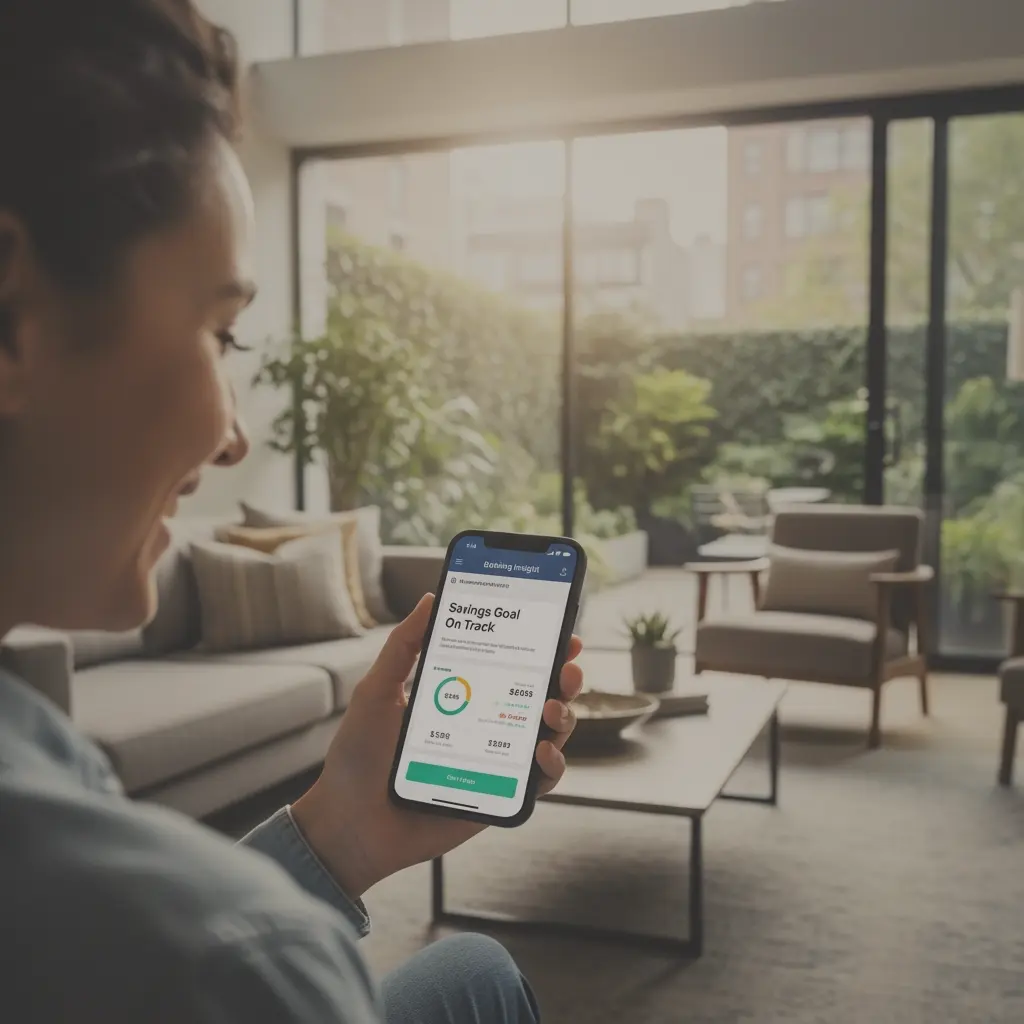

- Personalized Financial Insights: Use AI to analyze spending habits and provide customized budgeting tips, savings goals, or alerts about unusual spending patterns directly within the banking app.

- Tailored Content and Advice: Deliver educational content that matches the customer’s financial journey. A recent graduate might receive articles on managing student debt, while a customer nearing retirement could be sent information on investment strategies.

2. A True Omnichannel Experience

Customers interact with their bank through multiple touchpoints: the mobile app, website, ATM, physical branch, and contact center. An omnichannel strategy ensures that this experience is seamless and consistent, allowing customers to start a journey on one channel and complete it on another without friction.

Multichannel vs. Omnichannel: Multichannel means being present on various platforms. Omnichannel means integrating these platforms so they work together seamlessly. A customer might research a car loan on the bank’s website, receive a personalized offer via a push notification, start the application in the mobile app, and finalize the details with a loan officer in a branch—all without having to repeat information.

3. Proactive and Real-Time Communication

The best engagement is often proactive, not reactive. Instead of waiting for customers to encounter a problem, banks should use real-time communication to provide timely assistance and valuable information. This builds trust and shows the customer that their bank is looking out for their financial well-being.

- Intelligent Alerts: Go beyond simple transaction notifications. Send proactive push notifications for potential fraud alerts, low balance warnings to avoid overdraft fees, or reminders for upcoming bill payments.

- Trigger-Based Messaging: Automate communications based on customer actions. For instance, a large deposit could trigger an in-app message about high-yield savings or investment options.

- Contextual Offers: Use geolocation to send relevant offers. A customer using their card abroad could receive a push notification with information about international transaction fees and travel insurance options.

4. Frictionless Digital Self-Service

Modern customers value convenience and autonomy. They want the ability to manage their finances and solve problems on their own time, without needing to call support or visit a branch for every minor issue. Providing robust, intuitive self-service tools is crucial for engagement.

This includes features like easy card-locking/unlocking in the app, digital dispute resolution, simple fund transfers, and AI-powered chatbots that can answer common questions 24/7, freeing up human agents to handle more complex issues.

Key Technologies Driving Engagement in the Financial Sector

Technology is the engine that powers modern customer engagement. Financial institutions are increasingly adopting advanced tools to deliver the personalized, proactive, and seamless experiences that customers demand.

Artificial Intelligence (AI) and Machine Learning (ML)

AI is the brain behind hyper-personalization. Machine learning algorithms can analyze vast amounts of customer data to identify patterns, predict future behavior, and automate decision-making. This enables banks to create predictive models for everything from credit risk to customer churn, allowing them to intervene with the right message at the right time.

AI-Powered Chatbots and Virtual Assistants

Chatbots have become a frontline tool for customer service. Modern AI-powered chatbots can handle a wide range of queries, from checking account balances to guiding users through a loan application. They provide instant, 24/7 support, reducing wait times and improving customer satisfaction while lowering operational costs.

Customer Data Platforms (CDP)

To achieve a true omnichannel experience, banks need a unified view of the customer. A CDP ingests data from all touchpoints—transactions, app usage, website visits, call center interactions—and consolidates it into a single, comprehensive customer profile. This 360-degree view is the foundation for any effective personalization and engagement strategy.

Mobile Communication Channels

The smartphone is the primary banking channel for most customers. Leveraging mobile-native communication tools is non-negotiable for effective engagement.

- Push Notifications: The most direct way to reach customers with timely, important information. Perfect for fraud alerts, payment reminders, and personalized flash offers.

- In-App Messages: Ideal for communicating with customers while they are actively engaged with the banking app. Use them for onboarding new users, announcing new features, or providing contextual tips and educational content.

- Rich Push Notifications: Go beyond simple text. Use notifications with images, videos, and interactive buttons to create more engaging and actionable messages.

Actionable Strategies to Implement Today

Transforming your engagement strategy is a journey, but there are several high-impact initiatives you can start implementing right away.

1. Reinvent the Customer Onboarding Journey

The first 90 days are critical. Don’t just send a welcome email and stop. Create a structured, multi-channel onboarding campaign that guides new customers through activating their card, setting up the mobile app, and discovering key features. Use a series of automated in-app messages and push notifications to encourage adoption and build early habits.

2. Gamify Financial Wellness

Use gamification techniques to make saving and financial management more engaging. Create savings challenges, offer digital badges for reaching financial goals, or implement a rewards system for completing financial literacy modules within the app. This makes banking feel less like a chore and more like a rewarding experience.

3. Become a Source of Financial Education

Build trust by empowering customers with knowledge. Develop a rich library of content—blog posts, short videos, webinars, in-app guides—on topics like building credit, saving for a down payment, or understanding investment options. Use your communication channels to deliver this content to the right customer segments at the right time.

4. Actively Solicit and Act on Feedback

Show customers you are listening. Implement simple, non-intrusive ways to gather feedback, such as in-app Net Promoter Score (NPS) surveys after a key interaction. Most importantly, close the loop. Acknowledge the feedback and communicate the changes you are making based on customer suggestions. This demonstrates a genuine commitment to improving their experience.

The Future is Relational, Not Transactional

Customer engagement in banking is no longer a ‘nice-to-have’; it is the central pillar of a successful and sustainable business model. By moving beyond simple transactions and focusing on building lasting, value-driven relationships, banks can foster deep loyalty and unlock new avenues for growth. The key is to harness the power of data and technology to understand customers on an individual level and deliver the proactive, personalized, and seamless experiences they have come to expect. The institutions that embrace this new paradigm will be the undisputed leaders of the future financial landscape.