The CDP Advantage: Stitching Together a 360-Degree View of Your Banking Customer

The CDP Advantage: Stitching Together a 360-Degree View of Your Banking Customer

The Challenge: Banking’s Blind Spots

In today’s digital-first world, banks possess more customer data than ever before. Yet, for many executives, a true understanding of the customer remains elusive. Your data lives in silos: the core banking system tracks transactions, the CRM holds sales interactions, the support platform logs complaints, and marketing tools measure campaign clicks. This fragmentation creates a disjointed experience for customers and significant operational blind spots for your institution. The first step to solving this is achieving a true 360-degree view of your banking customer, and that requires a new data strategy.

The High Cost of a Fragmented Customer View

Operating with a fractured customer profile isn’t just inefficient; it’s a direct threat to your bottom line and brand reputation. When your marketing and support teams don’t share intelligence, the consequences are severe:

- Impersonal Engagement: Offering a car loan to a customer who just inquired about a mortgage shows a fundamental lack of awareness. This erodes trust and makes your communications feel like spam.

- Frustrating Support Experiences: Customers are forced to repeat their identity and issue details to multiple agents because the support channel has no context from their app usage or recent marketing interactions.

- Missed Commercial Opportunities: Without a unified view, you can’t proactively identify the ‘next best action’ or product for a customer, leaving potential revenue on the table for more agile fintech competitors.

- Increased Security Risks: Juggling data between multiple, poorly integrated platforms multiplies your vulnerabilities. Each handoff point is a potential target for phishing and data breaches.

What is a Customer Data Platform (CDP)? The Central Nervous System

A Customer Data Platform (CDP) is a system designed to solve the data fragmentation problem. It ingests data from all your disparate sources—transactional, behavioral, and demographic—and unifies it into a single, persistent profile for each customer. This creates the coveted ‘single customer view’. Unlike a CRM, which primarily tracks intentional customer interactions, a CDP is the intelligence layer that autonomously collects and stitches together every touchpoint into a coherent journey. This unified profile then becomes the source of truth for activating personalized, secure, and timely communications.

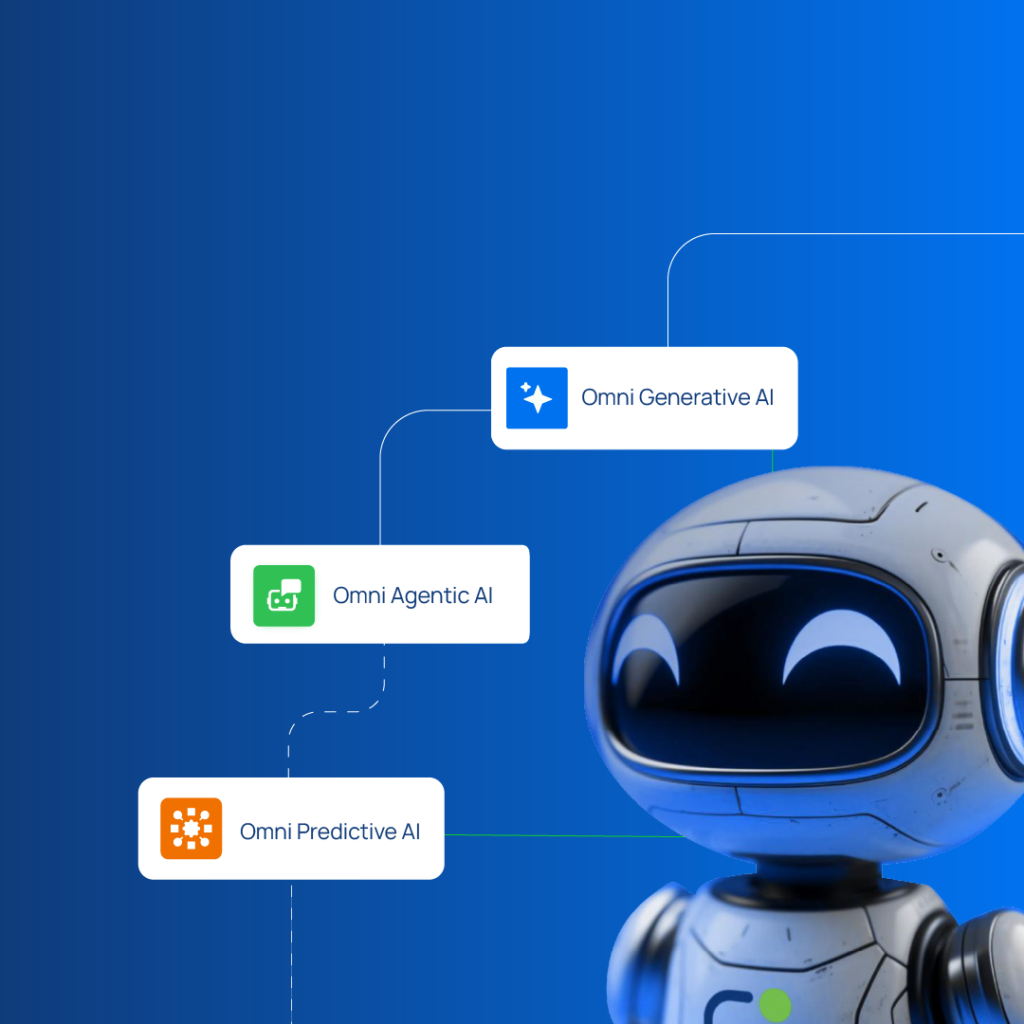

The indigitall Advantage: A CDP Built for Action, Not Just Integration

Many organizations invest in a standalone CDP only to spend the next 18 months on a costly and complex integration project, trying to connect it to their communication ‘plumbing’. indigitall rejects this flawed model. Our AI-powered engagement platform has a CDP built into its core, unifying marketing and support into ‘One Continuous Experience’ by default. 🚀

This integrated approach is a game-changer for financial institutions:

- Seamless Data Unification: Data from outbound marketing (Push, WhatsApp, RCS) and inbound support (AI Agents, Live Chat) flows into the same customer profile in real-time. No APIs to build or break.

- Instant Activation: A customer’s query to an AI Agent can immediately trigger a personalized marketing campaign or a secure fraud alert. This is true real-time engagement that a separate CDP can’t match.

- Reduced Costs & Complexity: By eliminating the need for a separate CDP vendor and the associated integration headaches, you simplify your tech stack. This directly contributes to the 40-60% support cost reduction our clients experience.

- Fortified Security: A unified platform drastically reduces the data handoffs that create security vulnerabilities. When combined with our proprietary Encrypted Push Notifications, you have a fortress for sensitive customer communication.

From Data to Dollars: Activating Your 360-Degree View

With indigitall’s built-in CDP, the 360-degree customer view isn’t just a dashboard; it’s a tool for driving tangible business outcomes:

- Proactive Retention: The platform can detect when a high-value customer’s app usage drops or they make a support inquiry about closing an account. This can trigger an automated alert to a relationship manager or a targeted retention offer via a secure channel.

- Hyper-Personalized Onboarding: Guide new customers through setting up their accounts with an orchestrated journey across in-app messages, push notifications, and helpful WhatsApp tips, all based on the actions they’ve taken (or failed to take).

- Intelligent Cross-Selling: The CDP identifies a customer who has a high savings balance and has recently received a large payroll deposit. This profile is perfect for an automated, personalized offer for investment services, boosting LTV by up to 80%.

Stop Stitching, Start Unifying

Building a 360-degree view of your banking customer is no longer a luxury—it’s essential for survival and growth. While traditional CDPs offer a piece of the puzzle, they often create new integration challenges. indigitall provides the complete solution: a single, AI-powered platform with a built-in CDP that unifies your data, secures your communications, and transforms your customer engagement from fragmented to seamless. It’s time to move beyond the plumbing and invest in the intelligence layer that will define the future of banking.