Blog

Credit Union Marketing: The Definitive Guide

Introduction to Credit Union Marketing

Credit unions are special because they’re owned by their members and focus on helping local communities. But with so many banks and online options, credit unions need strongcredit union marketing to stand out and attract new members.

This simple guide will help your credit union:

-

Attract new members – Learn easy ways to reach more people.

-

Keep current members happy – Build trust and loyalty.

-

Use digital tools – Try social media, emails, and online ads.

-

Get involved locally – Connect with your community through events.

Whether you’re just starting or want better ideas, this guide makes credit union marketing easy to understand.

Importance of Marketing for Credit Unions

Marketing helps credit unions grow and stay strong. Here’s why it matters:

1. Get New Members

Many people don’t know how great credit unions are. Good marketing helps spread the word and bring in new members.

2. Stand Out from Big Banks

Banks spend a lot on ads. Marketing helps credit unions compete by showing why they’re better (lower fees, local focus).

3. Keep Members Happy

Happy members stay longer! Marketing keeps them informed with helpful tips, updates, and rewards.

4. Show Community Support

Credit unions help local people. Marketing shares stories about scholarships, events, and small business loans.

5. Fight Misconceptions

Some think credit unions are “small” or “outdated.” Marketing proves they’re modern, tech-friendly, and member-focused.

Unique Challenges Faced by Credit Unions in the Financial Sector

While credit unions offer many advantages, they also face distinct challenges in the financial sector:

- Smaller Budgets – Less money for ads than big banks.

- Tech Upgrades – Hard to keep up with apps and online tools.

- Strict Rules – Must follow financial laws in all ads.

- Limited Membership – Can’t serve everyone (must qualify).

- Competition – Fintech apps (like Chime) attract younger users.

The Bottom Line:

Smart marketing helps credit unions grow, keep members, and stay competitive—even with fewer resources.

Know Your Members: The Key to Better Credit Union Marketing

To grow your credit union, you need to understand who your members are and what they want. Here’s how to do it simply:

Who Joins Credit Unions?

-

Average member age: 53 (older than most Americans)

-

Big opportunity: Younger adults (under 45) who don’t know credit union benefits yet

What Different Age Groups Want

Younger Members (Millennials & Gen Z)

✔ Mobile banking & apps

✔ No hidden fees

✔ Help with first-time loans (cars, homes)

✔ Quick online account access

Older Members (Gen X & Baby Boomers)

✔ In-person service at branches

✔ Retirement/financial planning

✔ Community involvement

How to Reach Them

-

Use Social Media – Post on Instagram/TikTok for younger members.

-

Offer Tech Tools – Mobile check deposit, budgeting apps.

-

Local Events – Sponsor youth sports or financial workshops.

-

Personal Help – Younger members want quick answers (chatbots or live chat).

Simple Member Groups to Target

-

First-time homebuyers → Mortgage help

-

College students → Free student accounts

-

Small businesses → Low-interest loans

Why This Works:

- Saves money – No wasted ads on the wrong people

- Builds trust – Shows you “get” their needs

- Brings in younger members – Keeps your credit union growing

Tip: Ask members what they want! Surveys or suggestion boxes help.

Developing a Strong Brand Identity

In the competitive financial services landscape, a strong brand identity is crucial for credit unions to differentiate themselves and attract members. Your brand identity encompasses your credit union’s values, personality, and unique offerings, all of which should resonate with your target audience.

Crafting a Compelling Unique Value Proposition (UVP)

Your Unique Value Proposition (UVP) is the cornerstone of your brand identity. It clearly communicates what sets your credit union apart from competitors and why potential members should choose you. To craft a compelling UVP:

- Identify your strengths: Focus on what your credit union does best. This could be exceptional customer service, community involvement, or innovative financial products.

- Understand member pain points: Address the specific challenges your target audience faces in their financial lives.

- Highlight member benefits: Clearly articulate how your credit union solves these pain points and improves members’ financial well-being.

- Keep it concise and clear: Your UVP should be easy to understand and memorable.

Example UVP: “At [Credit Union Name], we’re more than just a financial institution – we’re your neighbor, committed to providing personalized service and innovative solutions to help you achieve your financial dreams.”

Consistency in Branding Across All Channels

Maintaining brand consistency across all touchpoints is crucial for building recognition and trust. This includes:

- Visual consistency: Use a cohesive color palette, typography, and imagery across all marketing materials, from your website to branch signage.

- Tone of voice: Develop a consistent brand voice that reflects your credit union’s personality, whether it’s friendly and approachable or professional and authoritative.

- Messaging alignment: Ensure that your core messages and values are consistently communicated across all channels, from social media to in-person interactions.

- Employee training: Educate your staff about your brand identity and values to ensure they represent your credit union consistently in member interactions.

- Digital presence: Maintain a consistent look and feel across your website, mobile app, and online banking platforms.

Building Trust and Credibility Through Brand Messaging

Trust is paramount in financial services, and your brand messaging plays a crucial role in establishing and maintaining that trust. Here’s how to build credibility:

- Transparency: Be open about your products, services, and fees. Avoid hidden charges or complicated terms that could erode trust.

- Educational content: Provide valuable financial education resources to demonstrate your expertise and commitment to member financial well-being.

- Member testimonials: Showcase real stories from satisfied members to build social proof and credibility.

- Community involvement: Highlight your credit union’s contributions to the local community, reinforcing your commitment to member and community prosperity.

- Security messaging: Emphasize your commitment to protecting members’ financial information and assets.

- Consistent communication: Regularly update members on new services, community initiatives, and financial tips through newsletters, social media, and other channels.

- Personalization: Use data-driven insights to deliver personalized messages and offers that demonstrate your understanding of individual member needs.

Example trust-building message: “For over 50 years, [Credit Union Name] has been a trusted financial partner in our community. We’re committed to your financial success and security, offering personalized solutions and unwavering support at every stage of your financial journey.”

By developing a strong brand identity centered around a compelling UVP, maintaining consistency across all channels, and focusing on trust-building messaging, your credit union can create a powerful and memorable presence in the minds of current and potential members. This strong brand foundation will support all your marketing efforts and help drive member acquisition and retention.

Digital Marketing Strategies for Credit Unions

In today’s digital-first world, credit unions must leverage online channels to reach and engage potential and existing members. A comprehensive digital marketing strategy can help credit unions compete effectively with larger banks and fintech companies.

Website Optimization and User Experience

Your credit union’s website is often the first point of contact for potential members. To make a strong impression:

- Simplify navigation: Ensure your site has an intuitive structure that prioritizes essential functions like account access and loan applications.

- Implement mobile-first design: With mobile traffic dominating, optimize your site for seamless navigation and fast load times on smartphones and tablets.

- Streamline application processes: Break loan and membership applications into easy, digestible steps to reduce abandonment rates.

- Personalize the experience: Leverage data to offer tailored content and recommendations based on member behavior.

- Improve load times: Optimize your site’s speed by compressing images and reducing server requests.

- Ensure ADA compliance: Make your site accessible to all users, including those with disabilities.

Search Engine Optimization (SEO) Techniques

Improving your credit union’s visibility in search results can significantly increase organic traffic:

- Conduct keyword research: Focus on credit union-specific keywords and local search terms.

- Optimize meta tags: Create compelling title tags and meta descriptions for each page.

- Develop local SEO: Optimize for location-based searches to capture members in your credit union’s geographic area.

- Create quality content: Regularly publish relevant, informative content that addresses member needs and questions.

- Build backlinks: Develop partnerships with local businesses and organizations to earn quality backlinks.

Content Marketing and Thought Leadership

Establishing your credit union as a trusted source of financial information can boost credibility and member engagement:

- Develop a content strategy: Create valuable, educational content that empowers members to make informed financial decisions.

- Offer diverse content formats: Provide blog posts, videos, infographics, and interactive tools like financial calculators.

- Address member pain points: Create content that solves common financial challenges faced by your target audience.

- Showcase expertise: Publish thought leadership pieces from your credit union’s executives and financial experts.

Social Media Marketing for Community Engagement

Social media platforms offer opportunities to build relationships and showcase your credit union’s community involvement:

- Choose appropriate platforms: Focus on channels where your target audience is most active, such as Facebook, Instagram, or LinkedIn.

- Share valuable content: Post financial tips, member success stories, and community involvement highlights.

- Engage with followers: Respond promptly to comments and messages, fostering a sense of community.

- Run social media contests: Encourage engagement and attract new followers with creative, finance-themed contests.

Email Marketing Campaigns

Email remains a powerful tool for nurturing relationships with members:

- Segment your audience: Tailor messages based on member demographics, behaviors, and preferences.

- Personalize content: Use member data to create relevant, personalized email content.

- Automate campaigns: Set up triggered emails for events like account milestones or loan application follow-ups.

- Optimize for mobile: Ensure your emails are easily readable on mobile devices.

- Monitor and improve: Regularly analyze email performance metrics and A/B test to improve engagement.

Pay-Per-Click (PPC) Advertising

PPC campaigns can drive immediate traffic and complement your organic search efforts:

- Target specific keywords: Focus on high-intent keywords related to credit union services.

- Utilize geo-targeting: Limit your ads to your credit union’s service area for more efficient spending.

- Create compelling ad copy: Highlight your credit union’s unique value proposition and current offers.

- Implement retargeting: Show ads to users who have previously visited your website but didn’t convert.

- Monitor and optimize: Regularly review campaign performance and adjust bids, ad copy, and landing pages for better results.

By implementing these digital marketing strategies, credit unions can effectively reach and engage potential members, compete with larger financial institutions, and drive growth in the digital age. Remember to continually analyze and refine your approaches based on performance data and evolving member needs.

Traditional Marketing Tactics for Credit Unions

While digital marketing is essential in today’s landscape, traditional marketing tactics still hold significant value for credit unions. These strategies can enhance community presence, build relationships, and effectively reach members who may not engage with digital channels. Here are some key traditional marketing tactics that credit unions can employ:

Community Involvement and Sponsorships

Community engagement is at the heart of credit union values. By actively participating in local events and initiatives, credit unions can strengthen their brand and foster goodwill:

- Sponsorship of Local Events: Partner with community events such as fairs, festivals, or sports teams. Sponsorship not only increases visibility but also demonstrates your commitment to supporting local causes.

- Financial Education Workshops: Offer free workshops on budgeting, saving, and financial literacy in schools or community centers. This positions your credit union as a trusted advisor and resource.

- Charitable Initiatives: Organize or participate in charity drives, fundraisers, or volunteer opportunities. Highlighting your involvement in community service can enhance your reputation and attract members who value social responsibility.

- Collaborations with Local Businesses: Form partnerships with local businesses to create joint promotions or referral programs that benefit both parties and encourage community engagement.

Print Advertising and Direct Mail

Despite the rise of digital media, print advertising remains an effective way to reach certain demographics:

- Local Newspapers and Magazines: Advertise in community publications to reach potential members who prefer traditional media. Highlight your unique offerings and community involvement to resonate with readers.

- Direct Mail Campaigns: Use targeted direct mail campaigns to send personalized offers or information about new products and services to existing and potential members. Consider using eye-catching designs and clear calls-to-action.

- Brochures and Flyers: Create informative brochures or flyers that outline your services, benefits, and community involvement. Distribute these materials at local events, branches, or partner locations.

- Posters in Branches: Use posters within your branches to promote special offers or upcoming events, ensuring that existing members are aware of all available services. To create eye-catching and personalized visuals, use AI posters to quickly design professional promotions that keep your branch members informed and engaged.

Radio and Television Advertising

Broadcast media can effectively reach a broad audience and create brand awareness:

- Local Radio Spots: Sponsor segments or run ads on local radio stations that cater to your target demographic. Consider creating engaging content that highlights member stories or financial tips.

- Television Commercials: Develop short commercials that showcase your credit union’s values, services, and community contributions. Target local channels during peak viewing times to maximize reach.

- Interviews and Features: Seek opportunities for interviews on local radio or TV shows to discuss financial topics or promote upcoming events. This positions your credit union as a knowledgeable resource in the community.

- Public Service Announcements (PSAs): Create PSAs that focus on financial literacy or community initiatives. These can be aired for free on local stations as part of their commitment to public service.

Branch Marketing and In-Person Events

Your physical branches serve as vital touchpoints for member engagement:

- In-Branch Promotions: Create attractive displays highlighting current promotions or new products within your branches to capture the attention of walk-in members.

- Member Appreciation Events: Host events such as open houses or member appreciation days featuring refreshments, giveaways, and educational sessions to strengthen relationships with existing members.

- Networking Events: Organize networking opportunities for local businesses or professionals within your branch space, fostering community connections while promoting your credit union’s services.

- Feedback Sessions: Hold regular feedback sessions where members can share their thoughts on products and services in person. This not only engages members but also provides valuable insights for continuous improvement.

By integrating these traditional marketing tactics into their overall strategy, credit unions can effectively connect with their communities, enhance brand visibility, and foster lasting relationships with both current and prospective members. Balancing traditional approaches with digital strategies ensures a comprehensive marketing plan that resonates across diverse member segments.

Leveraging Data and Analytics

In today’s competitive financial landscape, data-driven decision making has become crucial for credit unions to stay relevant and grow their membership base. By harnessing the power of data and analytics, credit unions can gain valuable insights into member behavior, optimize marketing strategies, and improve overall performance.

Importance of Data-Driven Decision Making

Data-driven decision making allows credit unions to:

- Understand member needs: Analyze member data to identify patterns, preferences, and pain points, enabling more personalized services and

- targeted marketing efforts.

- Optimize resource allocation: Use data to determine which marketing channels and campaigns are most effective, allowing for more efficient budget allocation.

- Predict future trends: Leverage predictive analytics to anticipate member needs and market shifts, staying ahead of the competition.

- Improve risk management: Analyze data to better assess credit risks and detect potential fraud, enhancing the overall financial health of the credit union.

- Enhance member experience: Use data insights to streamline processes, reduce wait times, and improve overall member satisfaction.

Key Performance Indicators (KPIs) for Credit Union Marketing

To effectively measure the success of marketing efforts, credit unions should focus on these essential KPIs:

- Member acquisition cost: The average cost of acquiring a new member through marketing efforts.

- Member retention rate: The percentage of members who remain with the credit union over a specific period.

- Loan-to-share ratio: The proportion of loans to member deposits, indicating the credit union’s lending efficiency.

- Cross-sell ratio: The average number of products or services used by each member.

- Net Promoter Score (NPS): A measure of member loyalty and likelihood to recommend the credit union to others.

- Marketing ROI: The return on investment for specific marketing campaigns or channels.

- Website and mobile app engagement: Metrics such as unique visitors, time spent on site, and conversion rates.

- Social media engagement: Follower growth, post engagement rates, and social media-driven conversions.

- Email marketing performance: Open rates, click-through rates, and conversion rates for email campaigns.

Tools and Techniques for Data Analysis and Reporting

To effectively leverage data and analytics, credit unions can employ various tools and techniques:

- Omnichannel member engagement platforms: Centralize member data and interactions, providing a comprehensive view of each member’s relationship with the credit union.

- Data visualization tools: Use platforms like Tableau or Power BI to create interactive dashboards and reports, making complex data easily understandable for decision-makers.

- Predictive analytics software: Employ machine learning algorithms to forecast member behavior, loan default risks, and market trends.

- A/B testing: Conduct experiments with different marketing messages, designs, or offers to determine which performs best with your target audience.

- Segmentation analysis: Divide your membership base into distinct groups based on demographics, behavior, or preferences to tailor marketing strategies.

- Attribution modeling: Analyze the impact of various marketing touchpoints on member acquisition and engagement to optimize the marketing mix.

- Real-time analytics: Implement tools that provide up-to-the-minute insights on member behavior and campaign performance, allowing for quick adjustments.

- Data integration platforms: Combine data from multiple sources (e.g., core banking systems, social media, website analytics) for a holistic view of member interactions.

By leveraging these data-driven approaches, credit unions can make more informed decisions, allocate resources more effectively, and create marketing strategies that resonate with their target audience. The key is to continually collect, analyze, and act on data insights to stay competitive in the ever-evolving financial services landscape.

Remember, while data and analytics are powerful tools, they should be used in conjunction with human expertise and a deep understanding of your credit union’s unique membership base and community context. This balanced approach will lead to more effective marketing strategies and improved member experiences.

Personalization and Member Experience

In today’s financial services landscape, personalization is no longer a luxury—it’s an expectation. Credit unions that can deliver tailored experiences to their members are more likely to foster loyalty, increase engagement, and drive growth. By leveraging data and technology, credit unions can create personalized experiences that resonate with individual members across all touchpoints.

Tailoring Products and Services to Individual Needs

Personalized product offerings can significantly enhance member satisfaction and increase cross-selling opportunities:

- Life-stage based products: Develop and offer products that align with different life stages, such as student loans for young adults, mortgage products for first-time homebuyers, or retirement planning services for older members.

- Customized financial solutions: Use member data to recommend personalized savings plans, investment strategies, or debt consolidation options based on individual financial situations and goals.

- Flexible account features: Allow members to customize their accounts by choosing features that matter most to them, such as overdraft protection, rewards programs, or specific savings goals.

- Personalized loan terms: Offer tailored loan terms based on a member’s credit history, income, and relationship with the credit union.

- AI-powered product recommendations: Implement AI algorithms that analyze member behavior and financial patterns to suggest relevant products or services at the right time.

Creating Personalized Marketing Messages

Tailored marketing communications can significantly improve engagement and conversion rates:

- Segmented email campaigns: Divide your member base into segments based on demographics, behavior, or preferences, and create targeted email campaigns for each group.

- Dynamic content: Use member data to populate marketing materials with personalized content, such as name, recent transactions, or product recommendations.

- Behavioral triggers: Set up automated marketing messages triggered by specific member actions or milestones, such as account anniversaries or reaching savings goals.

- Personalized offers: Create individualized offers based on a member’s financial behavior, product usage, or life events.

- Multichannel personalization: Ensure consistent personalized messaging across all channels, including email, mobile apps, online banking platforms, and in-branch interactions.

Enhancing the Digital Banking Experience

A personalized digital banking experience can significantly improve member satisfaction and engagement:

- Customizable dashboards: Allow members to personalize their online and mobile banking interfaces, choosing which information and features are most prominently displayed.

- Personalized financial insights: Provide tailored financial advice and insights based on individual spending patterns, savings habits, and financial goals.

- Chatbots and virtual assistants: Implement AI-powered chatbots that can provide personalized support and answer member queries based on their account history and preferences.

- Predictive search and autocomplete: Use member data to power predictive search functions within digital banking platforms, making it easier for members to find relevant information or complete tasks.

- Personalized security settings: Allow members to customize their security preferences, such as biometric login options or transaction notification settings.

- Tailored educational content: Offer personalized financial education resources based on a member’s financial literacy level, interests, and goals.

- Smart budgeting tools: Provide AI-driven budgeting and savings tools that offer personalized recommendations based on individual spending patterns and financial objectives. Integrating resource scheduling software alongside these tools can help users efficiently allocate time and assets, ensuring both financial and operational goals are met with greater precision.

- Cross-device synchronization: Ensure a seamless experience across all devices, with personalized settings and preferences synced across platforms.

By implementing these personalization strategies, credit unions can create a more engaging, relevant, and valuable experience for their members. This approach not only enhances member satisfaction but also drives loyalty and encourages deeper relationships with the credit union.

Remember, successful personalization requires a delicate balance between leveraging data insights and respecting member privacy. Always be transparent about data usage and provide clear opt-out options for members who prefer less personalized experiences.

Ultimately, the goal of personalization is to make each member feel understood, valued, and supported in their unique financial journey. By consistently delivering personalized experiences, credit unions can differentiate themselves in a crowded market and build lasting relationships with their members.

Compliance and Regulatory Considerations

Credit unions operate in a highly regulated environment, and marketing efforts must adhere to various laws and regulations. Navigating these requirements while creating effective marketing campaigns is crucial for maintaining compliance and building trust with members.

Navigating Financial Marketing Regulations

Credit unions must be aware of and comply with several key regulations:

- Truth in Savings Act (TISA): Requires clear and accurate disclosure of terms for deposit accounts. Marketing materials must accurately represent interest rates, fees, and other account features.

- Fair Lending Laws: Prohibit discrimination in lending practices. Marketing campaigns should be inclusive and avoid targeting or excluding specific groups based on protected characteristics.

- Unfair, Deceptive, or Abusive Acts or Practices (UDAAP): Marketing messages must not be misleading or unfair to consumers. Avoid exaggerated claims or hidden fees.

- Regulation Z (Truth in Lending Act): Requires clear disclosure of loan terms. Advertisements for credit products must include specific information such as APR and repayment terms.

- Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations: While primarily focused on operations, marketing efforts should not inadvertently promote services that could be used for money laundering.

Ensuring Transparency in Marketing Communications

Transparency is key to maintaining compliance and building trust:

- Clear and conspicuous disclosures: Ensure all required disclosures are prominently displayed and easily understandable.

- Consistent messaging: Maintain consistency between marketing materials and actual product terms to avoid confusion or misrepresentation.

- Avoid fine print: Present important information clearly rather than hiding it in small text or footnotes.

- Use plain language: Explain financial terms and concepts in simple, easy-to-understand language.

- Accurate representations: Ensure all marketing claims are truthful and can be substantiated.

Balancing Promotional Content with Educational Resources

Credit unions should strive to balance promotional content with educational resources:

- Financial literacy initiatives: Offer educational content alongside promotional materials to help members make informed decisions.

- Transparent comparison tools: Provide tools that allow members to compare products objectively, including those from competitors.

- Risk disclosures: Clearly communicate potential risks associated with financial products or services.

- Member-centric approach: Focus on how products and services benefit members rather than solely pushing sales.

- Community involvement: Highlight the credit union’s commitment to financial education and community support.

Measuring Marketing Success

To ensure compliance and effectiveness, credit unions should:

- Conduct regular audits: Perform internal audits of marketing materials and processes to identify and address potential compliance issues.

- Train staff: Provide ongoing training to marketing and member-facing staff on regulatory requirements and compliance best practices.

- Monitor member feedback: Regularly review complaints and feedback to identify potential areas of confusion or dissatisfaction with marketing messages.

- Use data analytics: Leverage data to measure the effectiveness of marketing campaigns while ensuring compliance with data privacy regulations.

- Stay updated: Keep abreast of regulatory changes and update marketing strategies accordingly.

By carefully navigating financial marketing regulations, ensuring transparency, balancing promotional content with education, and implementing robust measurement and compliance systems, credit unions can create effective marketing campaigns that drive growth while maintaining regulatory compliance. This approach not only helps avoid potential penalties but also builds trust and credibility with members, reinforcing the credit union’s commitment to their financial well-being.

Measuring Marketing Success

In the competitive landscape of financial services, it’s crucial for credit unions to measure the effectiveness of their marketing efforts. By setting clear goals, tracking performance, and continuously optimizing strategies, credit unions can ensure their marketing investments deliver tangible results and drive growth.

Setting Clear Goals and Objectives

Establishing specific, measurable, achievable, relevant, and time-bound (SMART) goals is the foundation of successful marketing measurement:

- Membership growth: Set targets for new member acquisition, such as “Increase new memberships by 15% over the next 12 months.”

- Product adoption: Define goals for cross-selling and upselling, like “Increase the average number of products per member from 2.3 to 2.8 within the fiscal year.”

- Loan volume: Establish objectives for loan originations, such as “Grow auto loan volume by 20% in the coming quarter.”

- Digital engagement: Set targets for online and mobile banking adoption, e.g., “Increase mobile app users by 25% in the next six months.”

- Brand awareness: Define goals for improving brand recognition, like “Increase unaided brand recall among target demographic by 10% within one year.”

- Member satisfaction: Set objectives for improving member experience, such as “Achieve a Net Promoter Score of 70 or higher by the end of the year.”

Tracking and Analyzing Campaign Performance

To effectively measure marketing success, credit unions should:

- Implement robust analytics tools: Utilize web analytics, social media insights, and marketing automation platforms to track key performance indicators (KPIs).

- Set up conversion tracking: Monitor how marketing efforts translate into desired actions, such as loan applications or new account openings.

- Use attribution modeling: Understand which touchpoints in the marketing funnel are most effective in driving conversions.

- Conduct regular reporting: Create weekly, monthly, and quarterly reports to track progress towards marketing goals.

- Analyze channel performance: Assess the effectiveness of different marketing channels (e.g., email, social media, direct mail) to optimize resource allocation.

- Monitor competitor activity: Use competitive intelligence tools to benchmark your performance against other credit unions and financial institutions.

- Collect member feedback: Regularly survey members to gauge satisfaction and gather insights on marketing effectiveness.

Continuous Improvement and Optimization Strategies

To ensure ongoing marketing success, credit unions should:

- Conduct A/B testing: Continuously test different versions of marketing materials, such as email subject lines, ad copy, or landing pages, to identify what resonates best with your audience.

- Optimize for mobile: Regularly assess and improve the mobile experience of your website, emails, and digital ads to cater to the growing number of mobile users.

- Personalize marketing efforts: Use data insights to create more targeted and relevant marketing messages for different member segments.

- Refine audience targeting: Continuously analyze member data to refine your target audience and improve the efficiency of your marketing spend.

- Embrace agile marketing: Adopt an agile approach that allows for quick adjustments to marketing strategies based on real-time performance data.

- Invest in marketing technology: Stay updated with the latest martech solutions that can enhance your ability to measure and optimize marketing performance.

- Foster a data-driven culture: Encourage marketing teams to base decisions on data insights rather than assumptions or past practices.

- Conduct post-campaign analysis: After each major campaign, conduct a thorough analysis to identify successes, challenges, and areas for improvement.

- Stay informed about industry trends: Regularly attend conferences, webinars, and training sessions to stay updated on the latest marketing measurement techniques and best practices.

- Collaborate across departments: Work closely with other departments, such as IT and member services, to ensure a holistic approach to measuring and improving the member experience.

By implementing these strategies for measuring marketing success, credit unions can make data-driven decisions, allocate resources more effectively, and continuously improve their marketing efforts. This approach not only enhances the return on marketing investment but also ensures that marketing activities are aligned with the credit union’s overall strategic goals.

Remember, the key to successful marketing measurement is not just collecting data, but translating that data into actionable insights that drive meaningful improvements in your marketing strategies and, ultimately, your credit union’s growth and member satisfaction.

How indigitall Can Help

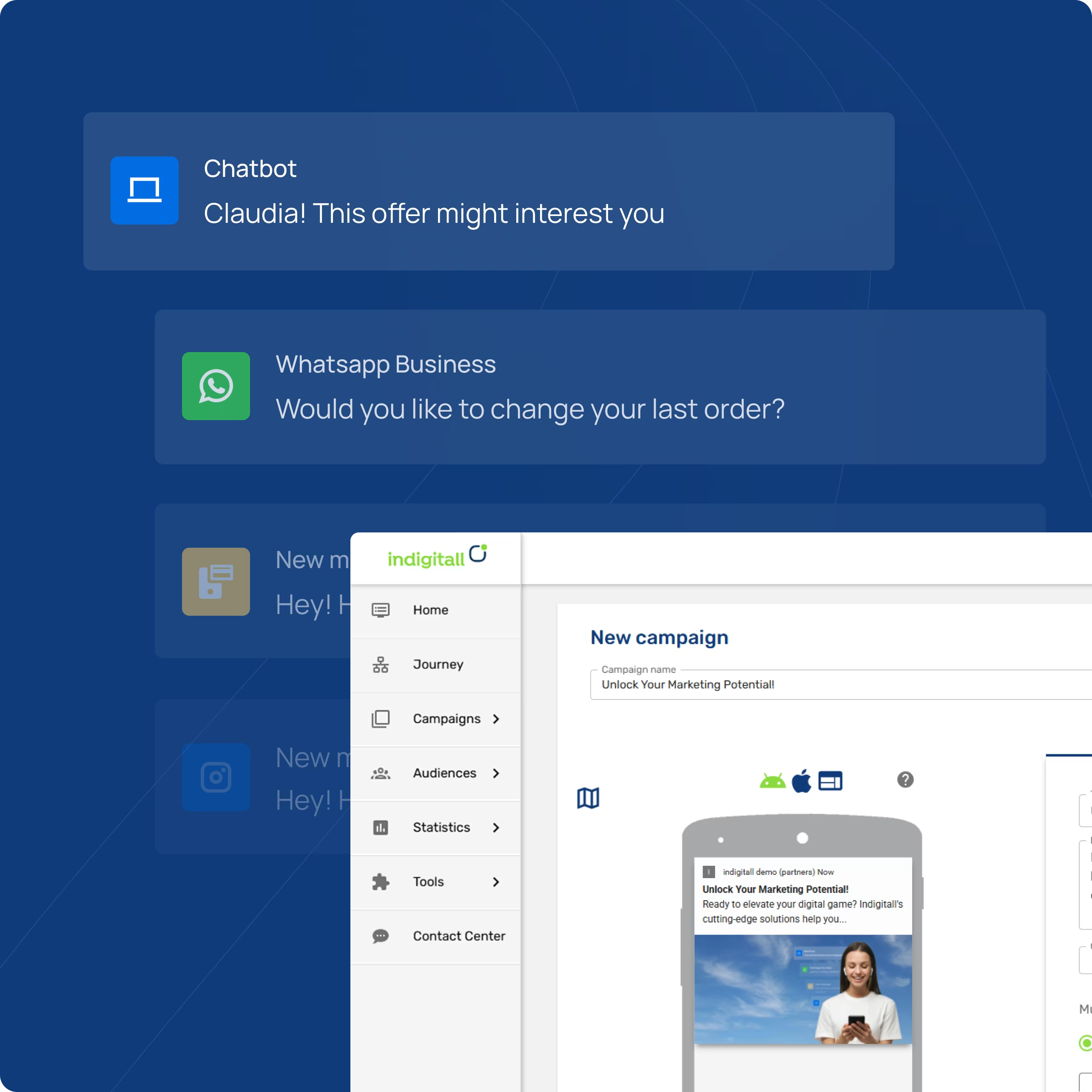

indigitall offers a comprehensive platform that can significantly enhance credit unions’ marketing strategies, enabling them to deliver personalized, efficient, and compliant marketing campaigns across multiple channels.

Streamlining Multi-Channel Marketing Efforts

indigitall provides a unified platform for managing marketing communications across various channels:

- Seamlessly integrate with popular CRMs like Salesforce, Adobe, and HubSpot.

- Connect to multiple digital channels including mobile apps, push notifications, Google and Apple Wallet, email, and messaging apps like WhatsApp, Teams, Messenger, and Instagram.

- Create cohesive marketing campaigns that deliver consistent messaging across all touchpoints.

Enhancing Personalization Through Advanced Segmentation

Leverage indigitall’s AI-powered segmentation capabilities to create highly targeted marketing campaigns:

- Apply advanced segmentation to your database and generate relevant campaigns for your users.

- Use machine learning functionalities to send communications based on user preferences.

- Create dynamic segments that update in real-time based on member behavior and interactions.

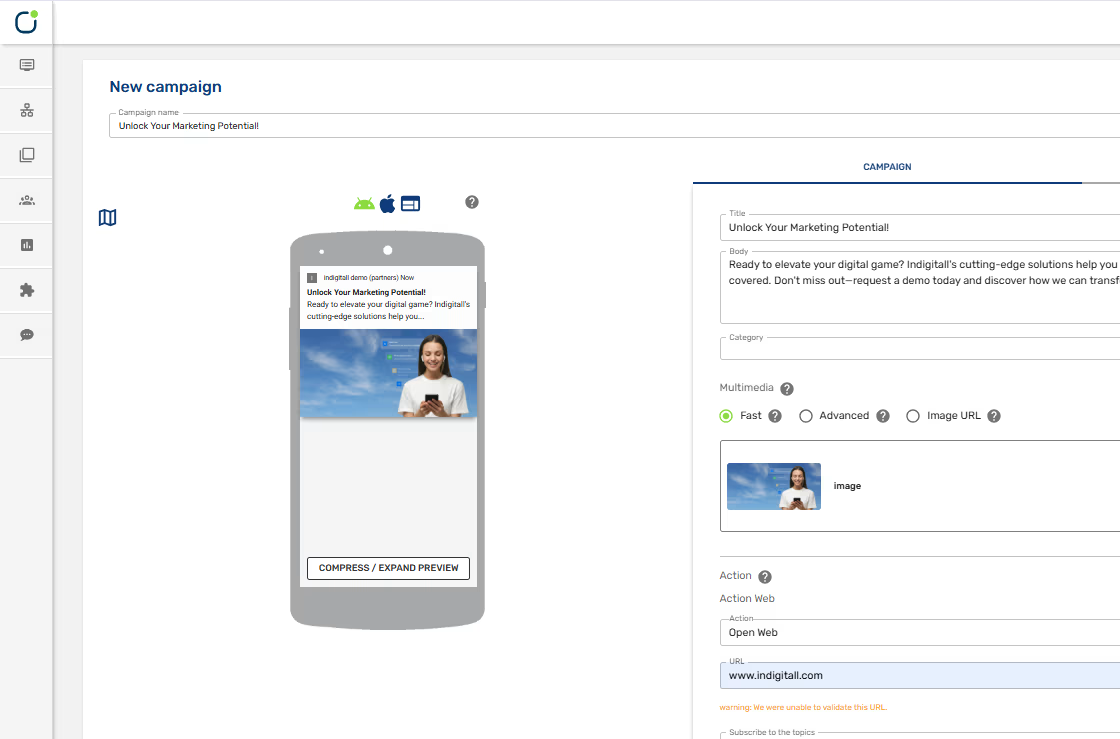

Improving Member Engagement with Push Notifications

indigitall’s push notification features can significantly boost member engagement:

- Send personalized, timely push notifications to keep members informed and engaged.

- Use location-based targeting to send relevant notifications based on members’ geographical location.

- Implement interactive and animated push notifications to capture members’ attention.

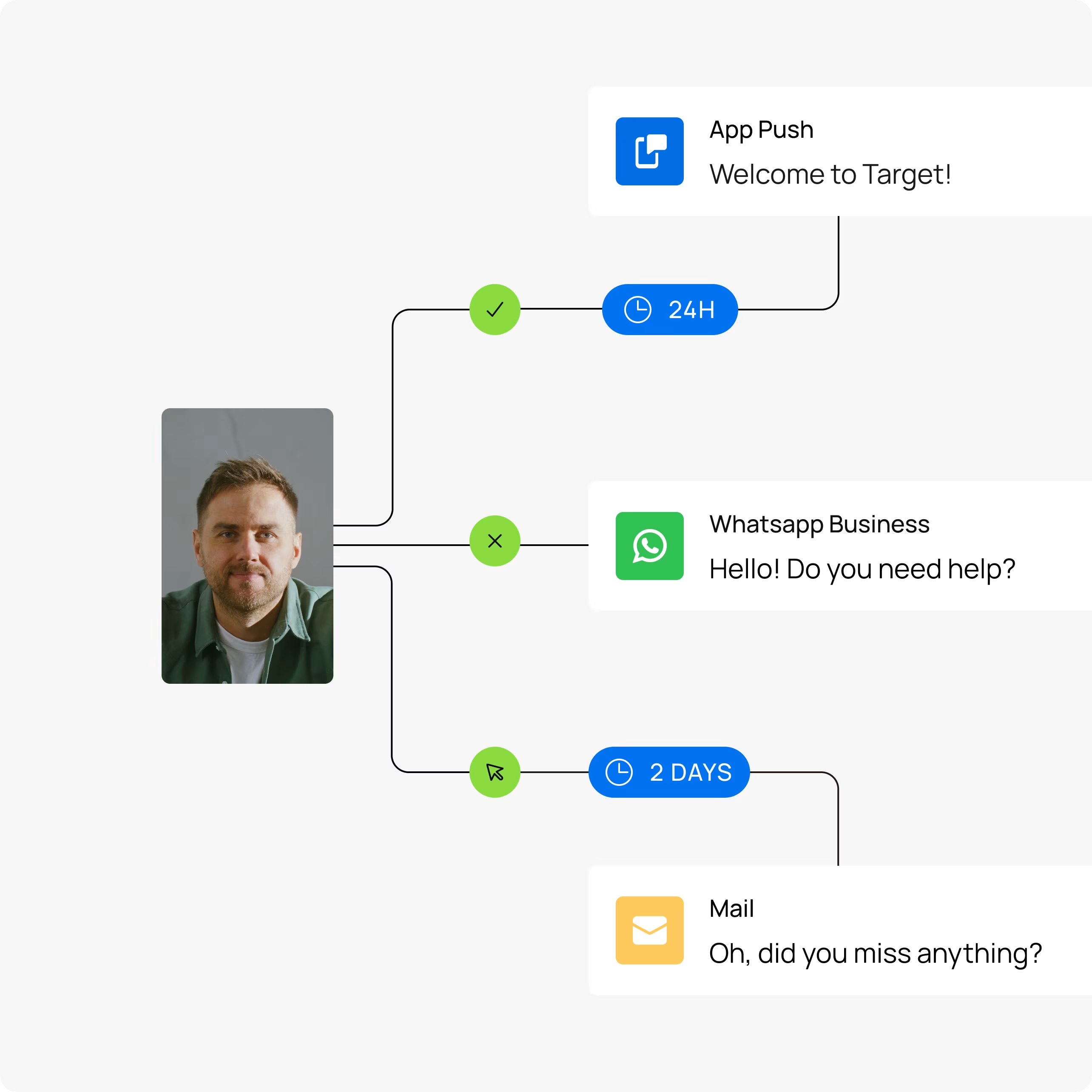

Automating Marketing Workflows for Increased Efficiency

indigitall’s automation capabilities can streamline your marketing processes:

- Automate communications by building workflows tailored to your members’ needs.

- Set up triggered messages based on specific user behaviors or segment membership.

- Use AI-powered chatbots to provide real-time customer support and engagement.

Providing Real-Time Analytics and Insights

Gain valuable insights into your marketing performance with indigitall’s analytics tools:

- Access detailed analysis and export reports to quantify which messages are driving engagement and conversions.

- Use predictive analytics to forecast future customer behaviors and optimize your marketing strategies.

- Monitor campaign performance in real-time and make data-driven decisions to improve results.

Ensuring Compliance with Data Protection Regulations

indigitall helps credit unions maintain compliance while executing effective marketing campaigns:

- Implement encrypted push notifications to ensure secure communication with members.

- Adhere to data protection regulations by providing members control over their data and communication preferences.

- Maintain transparency in data usage and provide clear opt-out options for personalized communications.

By leveraging indigitall’s comprehensive suite of tools, credit unions can create more targeted, effective, and personalized marketing campaigns that drive engagement and conversions while maintaining regulatory compliance. The platform’s ability to integrate multiple channels, automate processes, and provide deep insights makes it an invaluable asset for credit unions looking to enhance their marketing efforts in today’s digital landscape.

Conclusion

In the ever-evolving landscape of financial services, credit unions must adopt a multifaceted approach to marketing to thrive and grow. This definitive guide has explored essential strategies that can help credit unions effectively engage with their members and attract new ones.

Recap of Key Strategies for Credit Union Marketing Success

- Understanding Your Target Audience: Identifying member demographics, analyzing needs and preferences, and employing effective segmentation strategies are foundational steps in creating targeted marketing campaigns.

- Developing a Strong Brand Identity: Crafting a compelling Unique Value Proposition (UVP), ensuring consistency across all branding channels, and building trust through transparent messaging are crucial for establishing a strong brand presence.

- Implementing Digital Marketing Strategies: Optimizing your website, utilizing SEO techniques, engaging in content marketing, leveraging social media, and employing email marketing and PPC advertising are vital for reaching today’s digital-savvy consumers.

- Utilizing Traditional Marketing Tactics: Community involvement, print advertising, radio and television spots, and in-person events remain effective ways to connect with local audiences and reinforce community ties.

- Leveraging Data and Analytics: Data-driven decision-making enables credit unions to understand member behavior, track performance through KPIs, and continuously improve marketing efforts.

- Focusing on Personalization and Member Experience: Tailoring products and services to individual needs, creating personalized marketing messages, and enhancing the digital banking experience can significantly boost member satisfaction and loyalty.

- Navigating Compliance and Regulatory Considerations: Ensuring adherence to financial regulations while maintaining transparency in communications is essential for building trust with members.

- Measuring Marketing Success: Setting clear goals, tracking campaign performance, and implementing continuous improvement strategies are critical for optimizing marketing efforts.

Importance of Adapting to Changing Member Needs and Technological Advancements

As the financial landscape continues to evolve with technological advancements and shifting consumer expectations, credit unions must remain agile. Adapting to changing member needs is not just about keeping pace; it’s about anticipating trends and proactively addressing them. This means investing in new technologies, embracing data-driven insights, and continually refining marketing strategies to resonate with diverse member segments.

In addition, fostering a culture of innovation within your credit union will empower your team to explore new ideas, experiment with emerging technologies, and enhance the overall member experience. By staying attuned to both industry trends and member feedback, credit unions can position themselves as trusted partners in their members’ financial journeys.

In conclusion, successful credit union marketing requires a holistic approach that combines traditional values with modern strategies. By leveraging the insights shared in this guide, credit unions can build stronger relationships with their members, drive growth, and thrive in an increasingly competitive marketplace. Embrace change, invest in your marketing efforts, and prioritize member satisfaction to ensure lasting success in the future.